A recent incident highlights how SBI staff alertness saves senior citizens from losing 13 lakhs in digital scam. In Hyderabad, a quick-thinking employee at the State Bank of India (SBI) successfully prevented a senior citizen from falling victim to a sophisticated fraud scheme. This case underscores the growing threat of digital scams, particularly targeting vulnerable individuals like senior citizens.

Contents

The Incident

The victim, a 61-year-old child specialist and long-time customer of SBI’s AC Guards branch, was approached by scammers claiming he was under “digital arrest.” This alarming tactic is part of a new wave of scams where fraudsters convince victims that they are being monitored and must comply with their demands. The scammers instructed him to withdraw his savings and break fixed deposits to avoid legal troubles.

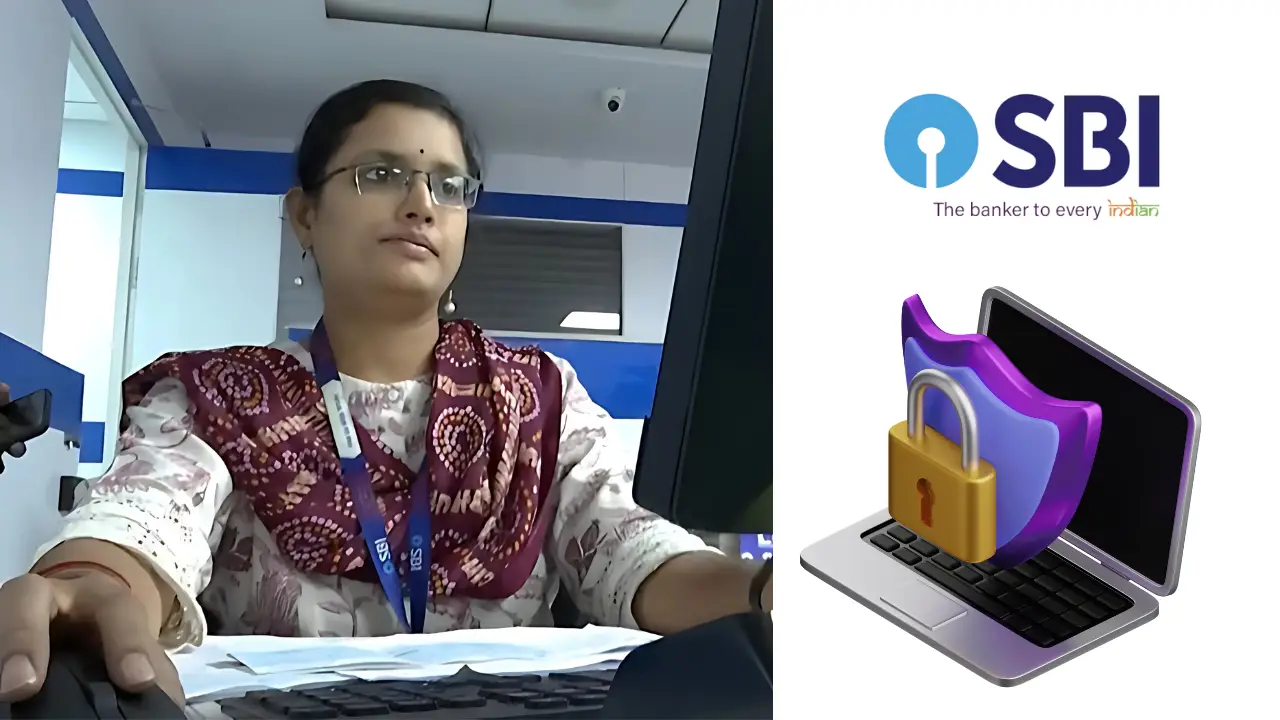

During his visit to the bank, the staff member Surya Swathi noticed the man’s anxious demeanor. Concerned about his large withdrawal request, she inquired further. The customer mentioned he needed the money for personal reasons but seemed unsure about how he would use it. This raised red flags for Swathi and her colleagues.

Quick Action by SBI Staff

Recognizing the potential scam, Swathi and branch manager Kumar Gaud took immediate action. They engaged the customer in conversation and asked him to return with a family member. This decision allowed them to delay the transaction for three days, giving them time to investigate further.

During this period, the elderly man attempted to withdraw money from another kiosk. However, the vigilant staff had already alerted each other about his situation. They closely monitored his activities and ensured that he did not succeed in bypassing their precautions.

On his third visit, Swathi presented him with an article from a credible source debunking the “digital arrest” scam. She also connected him to the national cybercrime helpline, where he learned that many others had fallen victim to similar schemes.

Understanding Digital Arrest Scams

What is a Digital Arrest Scam?

Digital arrest scams involve fraudsters convincing victims that they are under virtual custody. They instruct victims not to disclose their situation to anyone and often demand money transfers under threats of legal action or arrest. These scams exploit the fear and confusion of victims, making them more susceptible to manipulation.

Authorities have issued warnings about these scams, emphasizing that there is no such thing as “digital arrest.” However, many individuals, especially seniors who may not be tech-savvy, continue to fall prey to these deceptive tactics.

The Outcome

Thanks to the persistent efforts of SBI staff, the senior citizen finally recognized the scam and severed ties with the fraudsters. He expressed gratitude towards Swathi and her team for their intervention. Their vigilance not only saved him from losing ₹13 lakh but also highlighted the crucial role bank employees play in protecting customers from financial fraud.

Tips to Avoid Digital Scams

To prevent falling victim to similar scams, here are some essential tips:

- Never share personal information over phone calls or emails.

- Verify any suspicious calls claiming to be from banks or law enforcement.

- Contact your bank directly using verified phone numbers if you receive unusual requests.

- Educate yourself about common scams and stay informed about new tactics used by fraudsters.

The incident at SBI serves as a powerful reminder of how alertness can protect vulnerable individuals from financial harm. The proactive measures taken by bank employees not only saved a significant amount of money but also reinforced trust in banking institutions. As digital scams continue to evolve, it is essential for both banks and customers to remain vigilant against such threats.

Alert SBI Staff Save Senior Citizen From 13-Lakh ‘Digital Arrest’ Scam (Video Credit NDTV)

FAQs

What is a digital arrest scam?

A digital arrest scam is a type of fraud where scammers convince victims they are under virtual custody and must follow their instructions without informing anyone else.

How did SBI staff save the senior citizen?

SBI staff noticed inconsistencies in the customer’s story and delayed his transaction, ultimately helping him realize he was being scammed.

What should I do if I receive suspicious calls?

Do not share personal information; instead, verify the caller’s identity by contacting your bank directly through official channels.

Are digital arrests real?

No, there is no such thing as a digital arrest; this is a fraudulent tactic used by scammers.

How can I protect myself from scams?

Stay informed about common scams, never share personal information over unsecured channels, and always verify suspicious communications with your bank.

“Curious about what’s next in the tech universe? Let Tech Bichar guide you! Sign up for our newsletter and join our growing community on social media today.”